December is all about the holiday spirit, it is also a month of high spending for families with gift-giving, family get-togethers and parties. This can come at a price, and most Canadians work hard to manage their finances among the holiday cheer. RateSupermarket.ca is here to help with free, up to date information on the latest Canadian personal finance offers, guides, tips and articles to ensure you get more from your holiday purchases.

This holiday season, RateSupermarket.ca also wants to help parents teach their little ones about spending, saving and personal finance at a time where spending is at an all-time high and kids see mom opening her pocketbook more often. Here are a few tips and tricks to educate your little ones on financial literacy.

- Start early.

It’s never too early to talk to your children about financial responsibility. Start as soon as they’re able to count and make money the topic of regular family discussions. Enjoy a fun family night with Monopoly or The Game of Life to teach the importance of making smart money decisions. Monopoly can help children learn the importance of budgeting and setting aside an emergency fund. The Game of Life demonstrates how focusing on education can increase earning potential. A cash register and toy store can teach them that buying goods/presents comes at a cost.These lessons are especially important during the holiday season where they are due to receive cash gifts or gift cards – you can educate them on the importance of spending wisely. - Want VS. need.

We’ve all heard kids proclaim they NEED a toy or new gaming console. Don’t give them everything they ask for and don’t feel guilty about it. It’s important that children understand the difference between needs and wants, and that they may have to wait to buy something they desire. This will help encourage them to make sensible spending decisions. - Teach your child to save regularly and plan purchases.

Set up a process for saving money, whether in a piggy bank for young children or a bank account if they’re older. Regularly monitor to see how much they’ve saved and introduce goals for saving and planning larger purchases. You can find out which bank account on the market is best for your child’s needs here. - Money means choice.

Money is a finite resource, and therefore it is crucial for children to learn how to make wise choices about spending. If your kids are young, during story time read them a book that teaches the basics of budgeting and saving. Remember to chat through lessons-learned at the end.If you have a young adult, test out the Rewards Calculator on ca. It’s a quick, four-step tool that identifies which available credit card provides the best rewards for your needs (cash back, travel, gas or specialty rewards) based on your current, everyday spending habits. - Lead by example.

As a parent, you have a great deal of influence on your little ones, especially when it comes to financial habits. Children have a tendency to copy their parents’ behaviour, so be open about your spending habits and savings goals, and try to limit the amount of shopping trips you take as a leisure activity. They might start to think money is unlimited and spending is fun.

THE GIVEAWAY

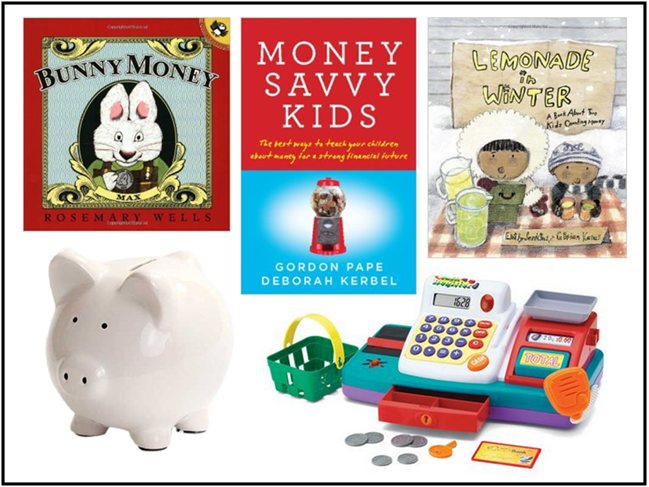

Win it: To help you teach your little one about spending, saving and personal finance, RateSupermarket.ca is excited to offer a fun-filled prize pack with educational games & books valued at $75 including the following:

- Cash Register – $19.99*

Keep your child busy scanning, calculating and weighing food. A pretend conveyor belt and scale allow kids to take care of pretend food. A scanner with beeping sounds and light let your child know the item was scanned properly. A working calculator with auto shut-off totals the bill and play money and a credit card take care of the total.

- Children’s Books – $10-15

- Ages 2 to 7 – Lemonade in Winter

“Lemonade in Winter” by Emily Jenkins and G. Brian Karas focuses on two siblings who make the interesting choice to open a lemonade stand in the middle of winter. The book features a catchy refrain about lemonade while telling a story about how sometimes great ideas don’t turn out like you hope. “Lemonade in Winter” teaches the very basics of entrepreneurship and a small amount of basic math. - Ages 3 to 7 – Bunny Money

Bunny Money” by Rosemary Wells centers around a pair of bunny siblings. In this story, Ruby has saved $100 to buy her grandmother a birthday present, but various unexpected events befall Ruby and Max, causing some of that money to disappear. Will they have enough to buy the gifts for grandmother?

- Ages 2 to 7 – Lemonade in Winter

- Money Savvy Kids: The Best Ways to Teach Your Children about Money for a Strong Financial Future – $15

- Money Savvy Kids is an indispensible, fun-to-read book by Gordon Pape and his daughter, Deborah Kerbel, which will help you get your children on the right track to understanding all about money. It contains sound, practical information from Canada’s most trusted financial writer plus many delightful and humorous personal stories that will leave you laughing while you learn.

- Piggy Bank – $14.99*

- Encourage your little one to start saving their allowance or monetary gifts with a cute piggy bank.

Note: The register or piggy bank might be slightly different than shown in the photo above.

Enter to win this amazing prize pack via Rafflecopter below. Good Luck!

Disclosure: I received compensation to facilitate this post. All views and opinions stated on this post are 100% my own.

62 Comments on “Tips For Teaching Your Kids About Money {Giveaway – $75 value!}”

I homeschool and I found the best thing is the grocery store he has learned how to count and how much things cost and how to weigh veggies and fruits on the scale. he has also learned how to find deals like mom those tomatoes are on sale there cheaper lets get those ones

I believe that they should spend half of their birthday money and save the other half.

We have a piggy bank for my son that has 3 sections: save, spend, donate. When he sees a toy he likes, we ask if he would like to use money from his bank. we remind him that once the money is spent, it’s gone. It really gets him thinking if he wants the toy or not

I think small chores for an allowance allows for some understanding.

I just remind them how important money is :). These ate great tips

My kids earn small amounts of money for doing chores around the house. We talk about saving up for things they want, or they can spend it at the dollar store.

Keep them busy and ask them to help while you do chores. Teach them basic life skills as you are doing it for him or her. Encourage questions.

We have the four piggies and they receive an allowance from the grandparents. When they receive a monetary gift for birthdays and Christmas, the money goes directly into their RESP. We talk to them about financial responsibility and the idea of ‘need’ and ‘want’.

Simply cash preferred card from American Express is the card that was recommended for me.

The card that was for me was simple cash card from american express

I got the American Express Gold Rewards Card.

The card that was recommended for me was the American Express Gold Rewards Card (Charge Card)

SimplyCash Card from American Express

SimplyCash Card from American Express

save half of gift money

It reccomended the American Express Gold Rewards Card (Charge Card) for me, but I don’t think most places around here take AMEX.

The Canadian Market was recommended

What a wonderful prize…Great teaching tools…

They suggested the MBNA Smart Cash MasterCard® Credit Card

It recommended Scotia bank gold amex. Teaching my kids about money is huge but I have been wondering where to start. Thanks!

It suggested the SimplyCash™ Preferred Card from American Express® for me.

More Rewards MasterCard credit card

The MBNA Smart Cash MasterCard Credit Card was recommended for me.

It recommended an American Express Gold Card.

Visited RateSupermarket.ca and the calculator recommended the Scotiabank®* Gold American Express® Card for me

Scotiabank®* Gold American Express® Card

It recommended American Express Gold Rewards Card for me

It recommended the SimplyCash™ Preferred Card from American Express®.

walmart mastercard!

They suggested the Scotiabank®* Gold American Express® Card.

I was recommended the Scotia Momentum Infinite Visa

It recommended the Shell CashBack MasterCard®* from BMO®.

The More Rewards MasterCard

simply cash american express

The card recommended for me was the Scotia Momentum® VISA Infinite Card

It would be the Walmart one 🙂

SimplyCash Preferred Card from American Express

SimplyCash™ Card from American Express®

American Express Gold card

American Express Gold Rewards Card

I got the simply cash american express

I make the kids clean then I give money

I got the Scotiabank Gold American Express

small chores for an allowance.

MBNA Smart Cash MasterCard® Credit Card

It recommended the Simply Cash preferred card from American Express…

it recommended Scotiabank Gold American Express

I got the American Express Gold Rewards Card.

It recommended the American Express Gold Rewards Card

It recommended the PC financial card.

Scotia Momentum® VISA Infinite Card

Lol funny cause I broke my daughter cash registers would love to get one to replace it 🙂

Amex Gold

The Scotia Momentum® VISA Infinite Card for me.

The Prferred card from American Express was recommended for me

It recommended the RBC Royal Bank Visa Infinite Avion but I’d prefer staying with my gold Amex.

MBNA Smart Cash MasterCard® Credit Card was chosen for me

RBC Royal Bank® Visa Infinite‡ Avion

American Express Gold Rewards Card

I was recommended the SimplyCash™ Preferred Card from American Express® card

It is so important for kids to learn about money and especially that you have to earn it first before you can spend it.

This article provides valuable tips for parents to teach their children about financial literacy, especially during the holiday season when spending tends to increase. It emphasizes starting early and engaging children in activities that promote understanding of money management.

But, I recently came across an intriguing article discussing the potential of fintech to replace traditional banking https://inoxoft.com/blog/fintech-vs-bank-can-fintech-replace-traditional-banking/ . This thought-provoking piece made me consider the future of financial services. The debate on the role of fintech in reshaping banking services adds an intriguing layer to discussions about financial literacy and the evolving landscape of personal finance.