Financial planning is crucial for securing your future and achieving your life goals. Whether just starting your family, or preparing for retirement, having a solid financial plan can make all the difference.

Today we are sharing 5 essential elements of sound financial planning, including the often-overlooked task of making a Will.

1. Setting Clear Financial Goals

The foundation of any sound financial plan is setting clear, achievable goals.

Whether buying a home, saving for your children’s education, or planning for retirement, having well-defined goals helps you stay focused and motivated.

How to Set Financial Goals:

- Identify your goals (short-term, medium-term, and long-term goals).

- Assign a dollar amount and timeline to each goal.

- Prioritize your goals based on importance and urgency.

- Review and adjust your goals periodically as your life circumstances change.

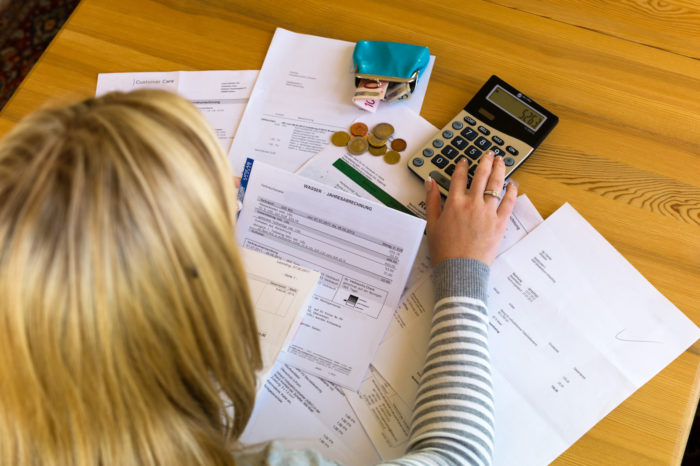

2. Budgeting and Managing Expenses

A budget is an essential tool for managing money and ensuring that spending aligns with financial goals. By tracking income and expenses, you can identify areas where you can cut back and save more. Creating a spreadsheet for your family expenses is helpful as it lets you see where your money is going and make informed decisions about your spending.

Tips for Effective Budgeting:

- List all sources of income and all monthly expenses.

- Categorize your expenses into fixed (rent, utilities) and variable (entertainment, dining out).

- Use budgeting apps or spreadsheets to monitor your spending.

- Adjust your budget as needed to stay on track with your financial goals.

3. Building an Emergency Fund & Getting Critical Illness Insurance

Life is unpredictable, and having an emergency fund can provide a financial safety net for you and your family in case of unexpected expenses like medical bills, car repairs, or job loss. An emergency fund should cover three to six months of living expenses.

Getting Critical Illness Insurance is also a must to be prepared for the unexpected.

With PolicyMe Canadians can get an instant quote for Critical Illness Insurance, apply in 20 minutes or less, and find out if they’re approved right away.

Building Your Emergency Fund:

- Set a target amount based on your monthly expenses.

- Start small by setting aside a manageable amount each month.

- Keep the fund in a separate, easily accessible savings account.

- Avoid using the fund for non-emergencies.

- Apply for Critical Illness Insurance

4. Investing for the Future

Investing is a critical component of financial planning that helps grow wealth over time. Investing in assets like stocks, bonds, or real estate can earn higher interest than regular savings accounts.

Investment Strategies:

- Diversify your portfolio to spread risk across different asset classes.

- Take a look at your risk tolerance and investment timeline.

- Review and rebalance your portfolio regularly to align with your goals.

- You can consult with a financial advisor to make informed investment decisions.

5. Making a Will and Estate Planning

Estate planning is often overlooked but is a vital part of financial planning. A Will ensures that your assets are distributed according to your wishes after death and can prevent potential legal disputes among your heirs.

Steps to Create a Will:

- List all your assets, including property, investments, and personal belongings.

- Decide how you want your assets distributed and who will be your beneficiaries.

- Choose an executor to carry out your wishes as specified in your Will.

- Consider setting up trusts if you have minor children or dependents with special needs.

- Regularly update your will to reflect changes in your life circumstances.

TIP: You can create your Will online using a platform like Epilogue. Epilogue is a simple, fast, and affordable way for Canadians to create their Will and Powers of Attorney online. By answering a series of straightforward questions, anyone can make a legally binding Will in 20 minutes—without leaving the comfort of their own home or ever having to step foot in a lawyer’s office. Use code SMILEYMONKEY20 for $20 off.

Good financial planning involves more than just saving money; it requires a holistic approach that encompasses setting clear goals, budgeting, building an emergency fund, investing wisely, and preparing for the future with a Will.

By incorporating these five elements into your financial strategy, you can achieve economic security and peace of mind, knowing you are well-prepared for whatever life throws your way.

Remember, it’s never too early or late to start planning for your financial future.

7 Comments on “5 Essential Elements of Good Financial Planning”

These are all excellent financial tips.

Great advice

I really hope schools start incorporating financial planning into the school programs, it is so important to learn about!

Great tips, thanks for sharing.

You touched on so many important points here!

I like how detailed you outlined the setting financial goals section, it really kickstarts the planning process.

These financial planning tips are spot on! I love how the article emphasizes setting clear goals and budgeting wisely fast food simulator. The advice on regularly reviewing and adjusting plans is a great reminder to stay on track.